Introduction

There are tax incentives for enrolling a person with a disability into a learnership commissioned by your organisation. This involves a deduction at commencement and another deduction upon completion.

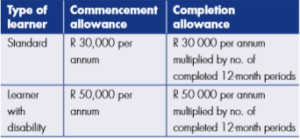

These are claimable from the South African Revenue Services (SARS) and is not related to the cash incentive offered by Fasset called the Learnership Cash Grant (LCG). The deductions are outlined below in Table 1.

Table 1: Tax deductions

Example

For example, if a learnership for one learner with a disability starts on the 1st of March 2018 and ends on the 30th of August 2019 (18 months) your organisation may claim a commencement allowance of R50 000 from SARS on the 1st of March 2018. They are then able to claim a R75000 (R50 000 x 1.5) completion allowance from SARS on the 30th of August 2019. A learnership shorter than 12 months requires that the allowance must be claimed pro-rata.

How to claim deduction

According to Fasset, the process to claim your deductions is not an onerous one. To claim your deduction you need to submit the following to SARS:

- IT 180 form required to claim the tax deduction through SARS

- Individual IRP5 with disability status

- Records from which the employees claimed their personal tax deductions

Note that tax deductions from SARS are not the only financial incentives for employing persons with a disability. There are Learnership Cash Grants (LCG), Strategic Cash Grants (SCG), SMME Grant, Assessor & Moderator Grant, Lifelong Learning (LL) events and Project funding.

Please consult the Fasset website for more information, the latest application forms, criteria, and submission dates.